保税制造Bonded Manufacturing

保税工厂的制造和加工计划Scheme for Manufacturing and Processing

in a Bonded Facility

印度允许在保税生产设施免税进口用于生产及其他操作的原材料和资本货物。

India allows duty-free import of raw materials and capital goods for manufacturing and other operations in a bonded manufacturing facility.

随着印度政府不断努力将印度打造为全球制造中心,并致力于改善营商环境,间接税中央委员会(CBIC)出台了另一项倡议,允许对保税生产工厂制造及其他业务所使用的原材料和资本货物免征进口关税。

With the Government’s continuous efforts to promote India as the manufacturing hub globally and the commitment towards ease of doing business, another initiative in this direction by the Central Board of Indirect Taxes (CBIC) is allowing import of raw materials and capital goods without payment of duty for manufacturing and other operations in a bonded manufacturing facility.

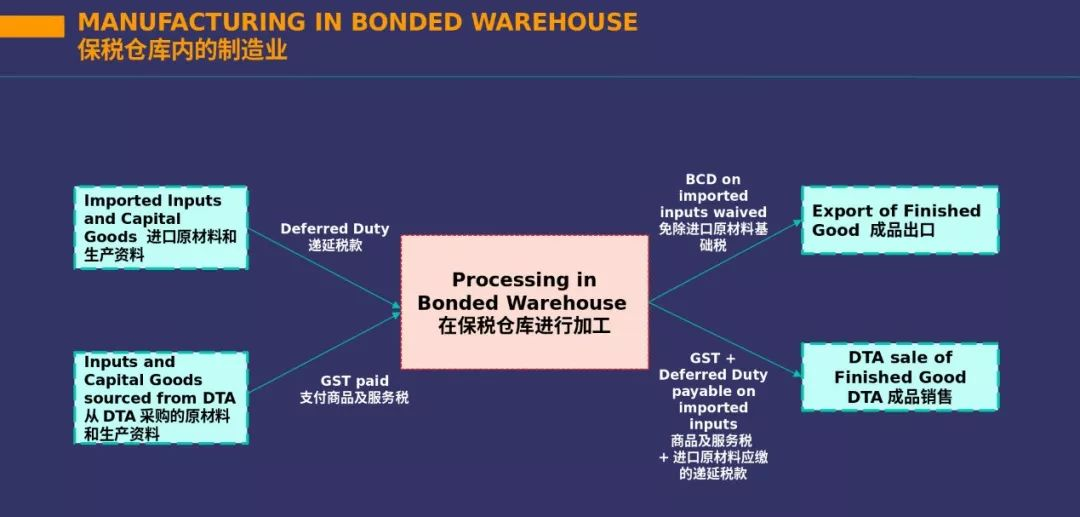

进口原材料或资本货物时,其进口税递延。若是为了出口而进口前述投入品,则免征其递延税。只有制成品通关进入国内市场后,才对生产中使用的进口原材料征收进口税。仅当资本货物通关进入国内市场时,才缴纳资本货物的进口税。

When the raw materials or capital goods are imported, the import duty on them is deferred. If these imported inputs are utilised for exports, the deferred duty is exempted. Only when the finished goods are cleared to the domestic market, import duty is to be paid on the imported raw materials used in the production. Import duty on capital goods is to be paid if and when the capital goods are cleared to the domestic market.

注意 Note

申请人必须遵守《海关法》(1962年)的规定,以及印度政府颁布的在印度经商所要遵守的所有其他规定。

The applicant must comply with the provisions of the Customs Act 1962, and with all other applicable compliances issued by the Government of India for doing business in India.

(DTA:国内关税区Domestic Tariff Area, GST:货物服务税Goods & Services Tax, BCD:基本关税Basic Customs Duty)

保税仓储的优势

Advantages of bonded warehousing

资本货物递延税 Deferred duty on capital goods

进口原料递延税 Deferred duty on imported raw materials

仓库无缝对接 Seamless warehouse to warehouse transfer

无固定出口义务 No fixed export obligation

保税制造的便易之处

Ease of bonded manufacturing

单点批准:海关税务司是所有审批的单一联系点。

Single point of approval: Commissioner of Customs acts as the single point of contact for all approvals

表格通用:通用的申请书兼批准表,私人保税工厂、制造和其他业务许可均适用。

Common form: Common application cum approval form for a license for private bonded facility and permission for manufacturing and other operations

无限期仓储:在清关或消费之前,资本货物和非资本货物(原材料,零件等)可一直保存在仓库中。

Unlimited period of warehousing: Capital and non-capital goods (raw materials, components, etc.) can remain warehoused until clearance or consumption

无地域限制:可在全印度建立新的生产工厂或将现有工厂改成保税工厂。

No geographical restriction: New manufacturing facility can be set up or an existing facility can be converted into a bonded manufacturing facility irrespective of its location in India

执行方便:所有制造和其他业务的记录仅需以数字形式按同一格式记录。

Easy compliance: Maintain all records of manufacturing and other operations digitally in a single format

受益人类型

Types of Beneficiaries

通过保税生产,所有类型的企业都无需缴纳用于生产出口成品的进口投入品的关税。就内消货物,进口投入品的关税将递延至制成品在国内市场清关时再缴纳。

Through bonded manufacturing, all types of businesses can avail exemption on customs duty on imported inputs used in the production of finished goods to be exported. In the case of domestic consumption, the duty on imported inputs is deferred until the finished goods are cleared to the domestic market.

为便于理解,下例说明制造商如何从保税制造中受益。

For better understanding, illustrations below show how a manufacturer benefit from bonded manufacturing.

一家领先的汽车制造商打算在印度制造汽车。

A leading automobile manufacturer intends to manufacture vehicles in India.

他们申请在马哈拉施特拉邦那格浦尔附近设厂,并进口了安全气囊、变速箱和资本财等生产所需的投入品。

They file an application for licensing a facility near Nagpur, Maharashtra and import required inputs for production like airbags, gearboxes and capital goods.

此类进口产品的关税递延,这为制造商提供了额外的营运资金支持。

The duty on such imports is deferred, which provides additional working capital support to the manufacturer.

制造商出口了所生产车辆总数的70%,则该部分的递延税可免除,而在印度全境内销售剩余30%的车辆时,需缴纳递延关税及跨邦消费税(IGST)。

The manufacturer exports 70% of the total produced vehicles and deferred duty on that portion is waived while deferred Custom Duty and IGST are paid on the remaining 30% vehicles at the time of their sale domestically across India.

由于免进口税,进口投入品的递延税以及降低的生产成本使制造商受益。

The manufacturer benefits from deferred duty on imported inputs and from reduced production cost due to duty-free imports.

以上便是关于保税工厂的制造和加工计划的介绍。

Comments | 0 条评论